Business credit is just like your personal credit score, but for your LLC. It helps lenders, suppliers, and partners assess the trustworthiness and financial stability of your business.

And when built correctly, it can unlock real financial power, providing access to credit cards, loans, and vendor lines specifically designed for businesses.

For LLC owners, business credit matters for 3 big reasons:

- It separates your personal and business finances, protecting your personal assets.

- It builds credibility with banks, vendors, and potential investors.

- It improves funding access, giving your business room to grow without personal guarantees.

The best part? You don’t need years of experience or a high personal credit score to get started. You just need the right structure, habits, and documentation in place.

However, qualifying for business credit isn’t easy, especially for new or international founders. That’s why having a trusted partner like doola makes all the difference.

doola helps you build a solid foundation from the start, so you can qualify for business credit faster and start building a financial reputation that works for your business, not against it.

In this blog, we’ll walk you through exactly how to qualify for business credit with your LLC , and position your LLC for long-term success.

What Is Business Credit? Why Does It Matter for LLCs?

Just like your personal credit score reflects your individual borrowing history, business credit reflects your company’s financial trustworthiness.

When your business applies for financing, lenders, vendors, and credit bureaus look at your business credit profile. This includes things like how long your business has been active, how promptly you pay invoices, your available credit lines, and your company’s revenue history.

However, unlike personal credit, which is tied to your Social Security Number (SSN), business credit is linked to your Employer Identification Number (EIN).

This separation is one of the biggest advantages of forming an LLC, as it allows your business to build its own credit profile independent of your personal finances.

It also offers:

- Higher Funding Limits: Banks and lenders are more likely to approve larger loans or credit lines for businesses with proven credit history.

- Better Loan and Credit Terms: Strong credit means lower interest rates and more favorable repayment schedules.

- Vendor and Supplier Trust: Many vendors offer Net-30 accounts (buy now, pay later within 30 days) to businesses with solid credit. This helps improve cash flow.

- Personal Asset Protection: With established business credit, you won’t need to rely on your personal credit or guarantees as often, keeping your assets safe.

- Growth Potential: From leasing office space to expanding inventory, business credit gives your company the financial freedom to scale confidently.

Why Does Business Credit Matter?

Without business credit, your LLC may struggle to secure loans, miss out on supplier discounts, or end up mixing personal and business finances.

A strong business credit profile signals to lenders and partners that your company is professional, reliable, and financially stable.

Even a small LLC can establish credibility, and with help from doola, you can do it faster and with fewer mistakes.

How to Qualify for Business Credit With Your LLC

Building credit isn’t something that happens overnight, but requires right structure and consistency. It all starts with setting up your LLC properly and ensuring it’s fully compliant.

Step 1: Make Sure Your LLC Is Legit and Compliant

Before applying for credit, you must ensure that your LLC appears and operates like a legitimate, established company. That means getting your legal foundation right from the start.

Here’s what you’ll need to have in place:

- Registered Business Name: Your LLC name must be unique and officially registered with your state.

- EIN: This is your company’s federal tax ID, required for tax filings, banking, and credit applications.

- Business Address (Not a P.O. Box): Many lenders won’t accept P.O. boxes. You can use your registered agent’s address or a virtual business address.

- Business Bank Account: This separates your business and personal finances, helping establish your company’s financial identity.

- Operating Agreement: Even if your state doesn’t require one, this internal document outlines ownership and management, which is key for credibility and compliance.

If your paperwork is incomplete or your information doesn’t match across government, banking, and business records, it can delay or even deny your credit applications.

That’s why you have to set up your LLC the right way. When your business is structured right, qualifying for credit becomes much easier.

doola takes care of the formation, compliance, and documentation, which are one of the biggest barriers for new entrepreneurs, especially international founders.

With doola, you can:

- Form your LLC in the U.S. quickly and fully compliant.

- Get your EIN (no SSN required for non-U.S. founders).

- Access U.S. business banking and keep your financial records organized.

- Stay compliant with annual filings and tax requirements from day one.

🔖 Related Read: International Businesses and EIN: Navigating US Requirements

Step 2: Establish Your Business Identity

A strong business identity makes your company easier to verify and signals that you’re trustworthy and established.

Before issuing credit, lenders often perform a background check to confirm that your company exists, is legitimate, and operates as a real business, not just a shell entity. They cross-reference your information across different databases, directories, and even online listings.

If your business name, address, and phone number aren’t consistent everywhere, your application might get delayed or denied.

Here’s how to establish your business identity the right way:

✔️ Maintain Consistent NAP (Name, Address, Phone)

- Your Name, Address, and Phone number (NAP) should match exactly across all documents and directories.

- Even small inconsistencies (like “Suite” vs. “Ste.” or using different phone numbers) can cause verification issues.

- Keep all business records and profiles uniform to build lender confidence and help credit bureaus correctly link your business data.

✔️ Create a Professional Website and Business Email Domain

- Buy a domain that matches your business name since having a business website can make a big difference when lenders research your business.

- Avoid using free email providers. Instead, create a business email using your domain (e.g., yourname@yourbusiness.com).

- Include key details on your website: your services, business address, contact information, and company story.

✔️ Get a Dedicated Business Phone Number

- A business phone number gives your business a professional touch.

- Make sure it’s listed on your website, email signature, and major business directories.

- If possible, list your number with 411 Directory Assistance. It’s one more verification source that credit bureaus use.

✔️ Register Your Business in Online Directories

- Add your LLC to trusted directories such as Google Business Profile, Yelp, Bing Places, LinkedIn, and Apple Maps.

- These listings improve your business’s online visibility and help lenders verify your existence quickly.

- Ensure all listings include your correct business name, address, phone number, and website (NAP consistency again!).

Step 3: Open a Business Bank Account

When you mix personal and business funds, you blur the financial line that legally protects you as an LLC owner. That’s a major red flag for lenders, tax authorities, and credit bureaus alike.

Opening a business bank account separates your business transactions from personal finances and creates an official record of your company’s financial activity.

Think of your business bank account as the “proof” that your LLC is legitimate and financially active.

What to Look For in a Business Bank Account

When you decide to open a business bank account, you have to find the one that fits your situation. Here’s what to consider:

- Reputation & Accessibility: Go for well-established banks or trusted fintech platforms like Mercury that support both U.S. and international founders.

- Ease of Setup: Many banks now allow you to open a business account online with minimal paperwork, especially if your LLC and EIN are already in place.

- Reporting & Integration: Some banks integrate directly with accounting software or credit bureaus, helping you track finances and build credit simultaneously.

- Low Fees: Watch for hidden fees like minimum balances or wire charges that can eat into profits.

- Global Compatibility: If you’re a non-U.S. founder, ensure your bank supports international transactions and remote account access.

Online fintech platforms such as Mercury is popular among startups and non-U.S. founders because they make the entire process seamless and credit-friendly.

How a Bank Account Builds Business Credit

A well-managed business bank account helps build your business credit profile by demonstrating financial consistency and reliability.

Here’s how it works:

- Consistent Deposits: Regular income shows lenders your business is stable and generates revenue.

- Responsible Expense Tracking: Keeping your expenses organized helps with tax filings and credit reviews.

- Cash Flow Management: Maintaining positive balances and avoiding overdrafts signals strong financial health.

- Loan Readiness: Banks often extend credit lines or business cards more easily to account holders with solid transaction histories.

Over time, your bank relationship becomes a key part of your business’s credit narrative, opening the door to vendor accounts, corporate cards, and financing opportunities.

Step 4: Apply for an EIN and Register with Business Credit Bureaus

To build business credit, your LLC needs its own financial identity that’s completely separate from your personal credit.

That starts with getting an EIN and registering your business with major business credit bureaus.

Without these 2 steps, you won’t be able to open business bank accounts, apply for credit cards, or establish vendor relationships.

Here’s why your EIN for business credit is essential:

- It separates your business from your personal identity.

- It’s required for opening a business bank account.

- Vendors, lenders, and credit bureaus use it to track your company’s financial activity.

- It’s necessary when filing business taxes or hiring employees.

🔖 Related Read: How to Open a US Business Bank Account?

How to Apply for an EIN

Applying for an EIN is free and straightforward. You can:

- Apply online via the IRS website: The fastest way, available to anyone with a valid SSN and ITIN.

- Apply by mail or fax: If you don’t have a U.S. SSN or ITIN, you can submit Form SS-4 by mail or fax directly to the IRS.

- Get your EIN: If you’re a non-U.S. founder or simply want a faster, error-free process, doola can handle your EIN application for you (no SSN required).

Once you’ve got your EIN, the next step is to register your business with commercial credit bureaus. Here’s how to get started:

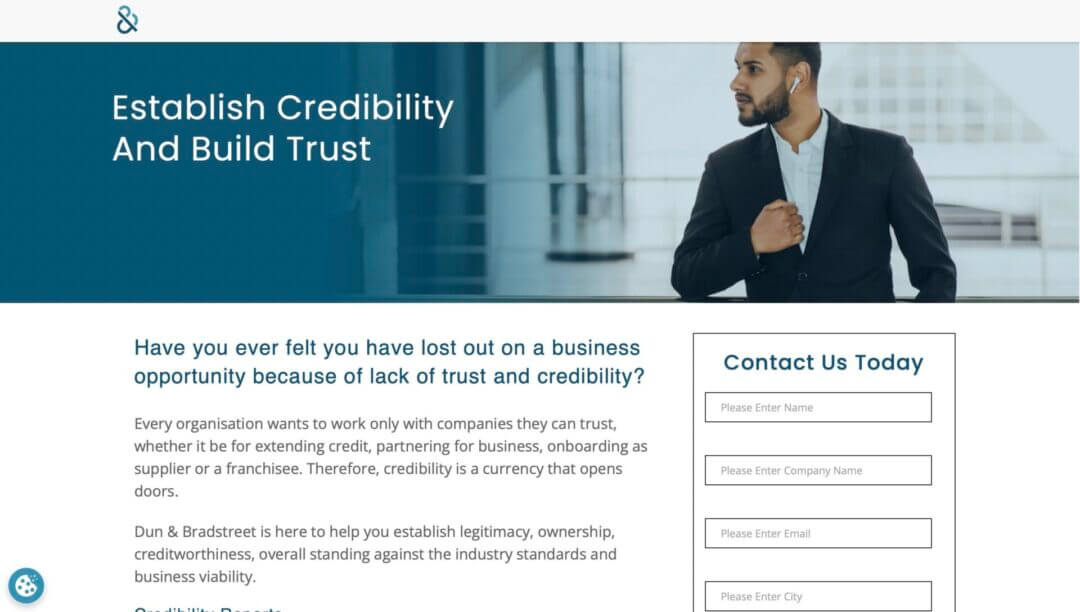

✔️ Dun & Bradstreet (D&B)

- This number is required by many vendors, government contracts, and major corporations.

- Once your D-U-N-S number is active, D&B will start tracking your payment history and assigning a PAYDEX score, which ranges from 0–100.

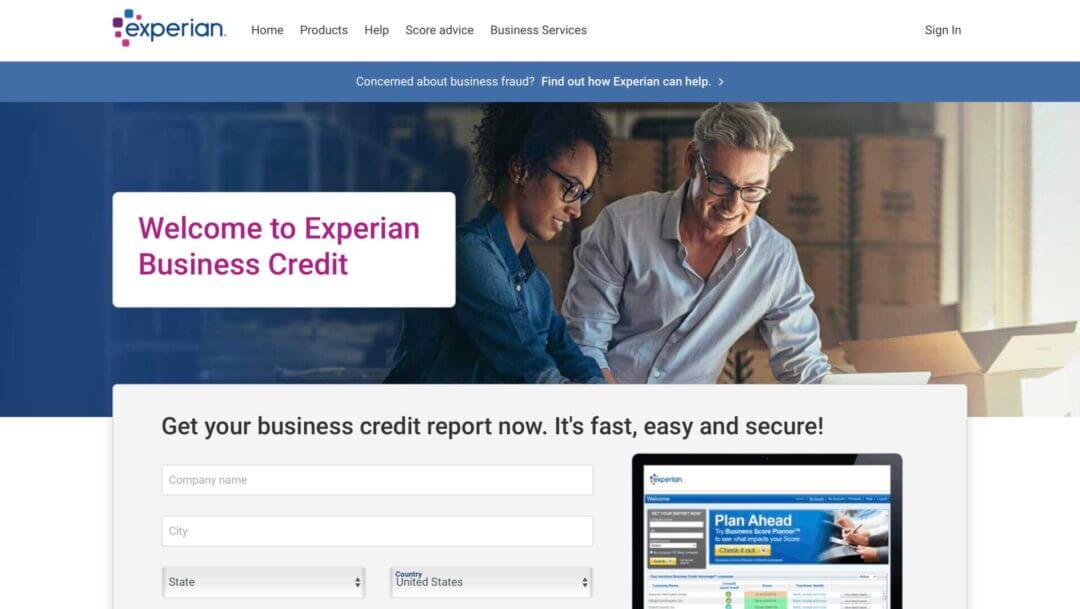

✔️ Experian Business

- Experian collects business credit data automatically when your LLC starts banking, using vendor credit, or applying for business financing.

- You can check your Experian Business profile through services like Nav.com or directly on Experian’s business site.

✔️ Equifax Small Business

- Like Experian, Equifax builds your business credit profile based on financial activity, supplier relationships, and payment reliability.

- You can register or monitor your business report through their small business portal.

🔖 Related Read: When and How to Use Your EIN: Practical Tips for Businesses

Step 5: Start with Vendor Credit (Net-30 Accounts)

The next step is to start building credit in action, and one of the easiest ways to do that is through vendor credit accounts, also known as Net-30 accounts.

With a Net-30 account, you typically have 30 days from the invoice date to pay for goods or services.

This type of credit isn’t a loan or credit card. It’s a short-term line of credit directly between your business and the vendor.

Every time you make an on-time (or early) payment to a vendor that reports to credit bureaus, your business earns a positive payment history.

Here’s how it strengthens your profile:

- Builds your Dun & Bradstreet PAYDEX Score (which measures payment reliability).

- Helps Experian Business and Equifax Small Business track your performance.

- Proves to lenders that your LLC can manage and repay credit responsibly.

- Improves your ability to qualify for higher credit limits and better financing later.

Start with 2–3 of these vendors, make small purchases, and pay your invoices early. Within 60–90 days, your business credit profile will start reflecting positive payment activity.

Here are some popular and beginner-friendly options:

👉🏼 Uline: Offers packaging, shipping, and warehouse supplies. Reports to Dun & Bradstreet and Experian.

👉🏼 Quill: Provides office supplies, cleaning products, and equipment. Reports to Dun & Bradstreet.

👉🏼 Grainger: Sells tools, hardware, and safety equipment. Reports to Dun & Bradstreet and Equifax.

👉🏼 Summa Office Supplies: Known for extending Net-30 accounts to new businesses with minimal requirements.

If your LLC is brand new, follow these tips to increase your approval chances and build credit faster:

- Apply with your EIN, not your SSN: This ensures your business credit is separate from personal credit.

- Keep details consistent: Make sure your business name, address, and phone number match what’s listed on your DUNS and EIN records.

- Start small: Place modest initial orders ($50–$100) and pay early to prove reliability.

- Track your reports: Use services like Nav or Dun & Bradstreet CreditSignal to monitor new trade lines and scores.

Step 7: Maintain Good Credit Habits and Monitor Progress

Once your LLC starts establishing a credit profile, it’s crucial to keep that momentum going through smart habits, consistent payments, and regular monitoring.

By practicing good financial discipline and tracking your credit activity, you can ensure that story stays strong and positive.

How to Check Your Business Credit Scores Regularly

Your business credit score isn’t automatically shared with you, so you have to actively monitor it.

Each bureau uses its own scoring model, but all focus on one key thing: your payment behavior. Here’s how to stay on top of your business credit reports:

✔️ Dun & Bradstreet (D&B):

- Sign up for CreditSignal (free), a free D&B service to track new trade lines and score updates.

- Track your PAYDEX Score ranges from 0 to 100. A higher scores reflect faster payments.

✔️ Experian Business:

- Reports include your Intelliscore Plus and financial stability score.

✔️ Equifax Small Business:

- Measures credit risk based on payment history and public records.

Best Practices to Maintain and Improve Business Credit

Follow these business credit improvement tips to keep your scores climbing:

✔️ Pay Early, Not Just On Time: Credit bureaus reward early payments. Aim to pay invoices 10–15 days before their due date to boost your D&B PAYDEX score.

✔️ Keep Utilization Low: Try not to use more than 30% of your available credit limit on any business card or line of credit. Low utilization signals stability.

✔️ Keep Credit Lines Active: Even if you don’t use a vendor or card often, make small purchases every few months to keep the account active and reporting.

✔️ Maintain Diverse Credit Sources: A mix of Net-30 accounts, credit cards, and loans shows lenders that your business can handle different types of financing.

✔️ Review Financials Monthly: Regularly review your balance sheets and cash flow to catch potential issues early. Clean books = easier financing approvals.

Common Mistakes That Can Hurt Your Credit

Even one small oversight can impact your business credit score. Avoid these pitfalls to protect your financial reputation:

❌ Mixing Personal and Business Credit: Always use your business EIN, not your SSN, when applying for credit or making business purchases.

❌ Paying Late (or Forgetting Payments): A single late payment can drop your score significantly and stay on record for years.

❌ Over-Applying for Credit: Too many credit inquiries in a short time can appear risky to lenders. Apply strategically.

❌ Ignoring Your Credit Reports: Errors happen. If you don’t review your reports, you can’t dispute inaccuracies that might hurt your score.

How doola Helps You Qualify for Business Credit

Lenders want to see a legitimate, verifiable business with all the basics in place: an EIN, a bank account, proper filings, and a clean compliance record. That’s what doola helps you solve.

Most credit rejections happen not because of bad credit, but because of incomplete or inconsistent business documentation.

At doola, we handle your entire business formation process, from filing your LLC to obtaining your EIN and opening a U.S. business bank account, a key requirement for lender or credit bureau.

With doola, your LLC is not only formed correctly but also maintained correctly. This keeps your LLC in good standing, which is something lenders look for when reviewing credit applications.

Sign up with doola today to form your LLC, get your EIN, and begin building business credit!

FAQs

Do I need an LLC to build business credit?

Yes. Credit bureaus and lenders only recognize businesses that have a registered legal structure, a separate EIN, and a business bank account.

How long does it take to establish business credit for an LLC?

Building a strong business credit profile (scores above 75 on Dun & Bradstreet’s PAYDEX scale) typically takes six months to a year of consistent payment and reporting activity.

If your LLC is properly set up and you start taking the right steps, you can start seeing your first credit activity in as little as 30–60 days.

What is a good business credit score?

A good business credit score varies by bureau, but here’s a general breakdown:

- Dun & Bradstreet (PAYDEX Score): 80+ = excellent (means you pay bills early or on time).

- Experian Business (Intelliscore Plus): 76–100 = low risk.

- Equifax Small Business: 90+ = strong creditworthiness.

Can a new LLC with no revenue qualify for business credit?

Yes, even a new LLC with no revenue or operating history can start building credit by:

- Opening Net-30 vendor accounts (e.g., Uline, Quill, Grainger).

- Applying for a secured business credit card.

- Keeping your LLC in good standing with clean records.

What’s the difference between vendor credit and business credit cards?

- Vendor Credit (Net-30 Accounts): Short-term financing from suppliers like “buy now, pay later” in which you pay within 30 days. Great for building initial credit history.

- Business Credit Cards: Revolving credit lines that report to commercial bureaus. They build long-term credit and help with everyday expenses.

How can international founders build U.S. business credit?

International founders can build U.S. business credit by:

✔️ Forming a U.S.-based LLC or corporation.

✔️ Getting an EIN (Employer Identification Number).

✔️ Opening a U.S. business bank account.

✔️ Setting up vendor or business credit lines that report to U.S. credit bureaus.

What happens if my LLC falls out of compliance? Does it affect my business credit?

Yes. If your LLC fails to file annual reports, misses tax deadlines, or loses its good standing with the state, lenders may flag your company as high risk.

News

Berita Teknologi

Berita Olahraga

Sports news

sports

Motivation

football prediction

technology

Berita Technologi

Berita Terkini

Tempat Wisata

News Flash

Football

Gaming

Game News

Gamers

Jasa Artikel

Jasa Backlink

Agen234

Agen234

Agen234

Resep

Download Film

A gaming center is a dedicated space where people come together to play video games, whether on PCs, consoles, or arcade machines. These centers can offer a range of services, from casual gaming sessions to competitive tournaments.