Forming an LLC itself is relatively easy. Filing the paperwork takes minutes. The real challenge begins after the LLC is formed.

You must keep your LLC compliant, manage taxes, handle registered agent requirements, open a bank account, and ensure that nothing slips through the cracks as your business grows.

That’s where LLC formation services start to look very different. Some companies focus only on filing your LLC and upselling add-ons later.

Others are built for long-term compliance, international founders, or businesses that plan to scale beyond a single state.

And that’s why there’s no one-size-fits-all answer to the “best” LLC formation company. The best company to start an LLC depends on:

✔️ Where you live (U.S. vs non-U.S.)

✔️ Whether privacy matters to you

✔️ How much ongoing compliance support do you need

✔️ Your budget today and over the next 12–24 months

✔️ Whether you’re building a side hustle or a serious, scalable business

In this guide, we’ll break down the top LLC formation services and compare them honestly, covering pricing, features, compliance support, and long-term value.

You’ll see a review of popular options and how doola stacks up against them to determine which one actually makes sense for your situation.

By the end, you’ll know exactly which LLC formation company is best for you, and why.

How We Evaluated the Best LLC Formation Companies

By scoring each LLC formation company across critical criteria, we identified those that deliver real value versus those that appear inexpensive at first but ultimately cost more over time.

Here are the criteria we used:

Pricing Transparency (Real Cost vs Advertised Cost)

Many companies advertise low prices that look great at first glance, but once you add essential services (registered agent, EIN, operating agreement, compliance alerts), the total cost skyrockets.

We looked at:

- Add-on costs for essentials

- Renewal fees (year 2 and beyond)

- Whether advertised prices reflect real out-of-pocket costs

A truly transparent provider displays all fees upfront, with no surprises after checkout.

Speed and Ease of Formation

Founders don’t want paperwork headaches or unclear instructions. We measured:

- How quickly each company can file your LLC

- Whether they offer expedited processing

- Ease of the onboarding process (clarity of forms, guided questions, UI/UX)

- Turnaround times from submission to approval

A fast and clear setup is crucial, especially when launching products, applying for banking, or activating payment processors.

Registered Agent Services

Great registered agent services are more than a mailing address. They’re your first line of compliance defense.

Every LLC needs a registered agent, and costs vary widely between providers. We evaluated:

- Whether the registered agent service is included or optional

- Quality of service (privacy protection, compliance reminders)

- How seamlessly the agent is integrated with the overall package

Compliance & Ongoing Support

LLC formation isn’t a one-time event; it’s a relationship. Companies that excel in this area help eliminate late fees, missed filings, and other costly mistakes.

We considered:

- Ongoing access to business experts

- Tools that help you stay in good standing over time

Suitability for Non-U.S. Founders

International founders face unique hurdles:

- Difficulty opening U.S. bank accounts

- Accessing payment processors like Stripe or Shopify Payments

We assessed how well each service supports non-U.S. founders with:

- EIN application assistance

- Remote onboarding workflows

This is a key differentiator for founders building global businesses.

Customer Support Quality

When problems arise, support quality matters. A quick and accurate answer from support can save hours (or even days) of confusion.

We analyzed:

- Responsiveness (email, chat, phone)

- Expertise of support staff

- Availability of educational resources

- Clarity and usefulness of guidance

Upsells and Hidden Fees

Some providers bury recurring costs or make essential features available only through high-priced upgrades. However, the best services minimize or eliminate surprise fees.

We checked:

- How often do upsells occur

- Whether core services are optional or required later

- If hidden fees appear during renewal or compliance cycles

🔖 Related Read: How Much Does an LLC Cost in Every State: 2026 Guide

Top LLC Formation Companies: At a Glance

Before diving into in-depth reviews, here’s a high-level LLC formation services comparison to give you immediate clarity on how the top providers stack up across core features most founders care about.

| Company | Starting Price | Turnaround Time | Registered Agent Included | Compliance Help | Best For |

| doola | $297/year + state filing fees (Transparent, All-Inclusive) | Fast (expedited options) | ✅ Included | ✅ Strong ongoing compliance support | Entrepreneurs & compliance-first businesses |

| LegalZoom | $329 + state filing fees (One-time fee, High) | Moderate | Optional (extra fee) | Moderate | Brand recognition & all-in-one founder support |

| Bizee (formerly Incfile) | $299 + state filing fees (One-time fee, Low entry) | Moderate/Fast | ✅ Free for 1 year | Basic | Budget-conscious founders |

| Northwest Registered Agent | $39 (One-time fee, Low) | Moderate | Optional (extra fee) | Strong | Privacy & registered agent quality |

| ZenBusiness | $0 (Free formation, Charges extra for essential services) | Moderate | Optional (extra fee) | Strong | Subscription-based support |

This table gives you a snapshot of where each service excels, without the noise.

In-Depth Reviews: Best LLC Formation Companies

Now that you’ve seen the snapshot comparison, let’s dig deeper into each provider, starting with doola.

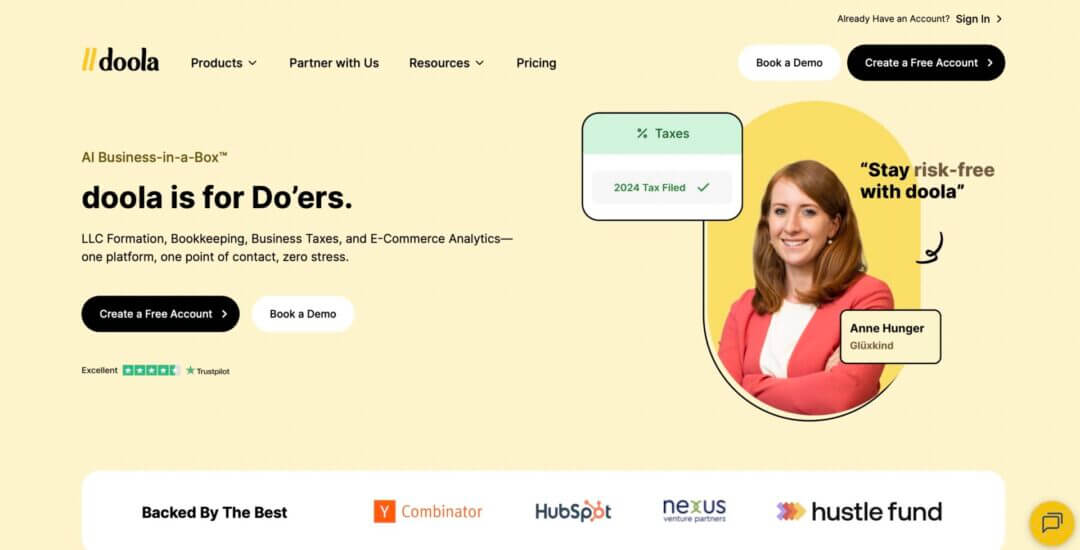

doola | Best for Entrepreneurs & Compliance-First Businesses

Rather than being “just a filing service,” doola is a business-in-a-box™ solution that emphasizes compliance, process integration, and a seamless path from LLC creation to business operations.

It’s designed for entrepreneurs in the US as well as international founders with a US-based business, who need end-to-end support, including formation, EIN, banking readiness, compliance guidance, and ongoing filings.

Strengths

- Global founder support: doola is structured from the ground up to serve entrepreneurs both inside and outside the U.S. Non-U.S. founders get dedicated guidance on EIN, banking, and compliance.

- Compliance-first focus: Annual filings, registered agent support, tax reminders, and ongoing compliance tools are included as standard.

- Clear pricing: Transparent costs with no hidden fees and surprise upsells during setup.

- End-to-end services: Beyond formation, doola supports EIN acquisition, tax filings, sales tax compliance, and bookkeeping. Ideal for founders who want a long-term business partner, not just a document-filing service.

Best for

- Non-U.S. founders seeking smooth access to EIN, U.S. banking, and payment processors.

- Compliance-focused businesses that need ongoing support beyond the initial formation.

- E-commerce sellers, SaaS founders, and remote businesses looking for a formation and compliance partner, not just a filing tool.

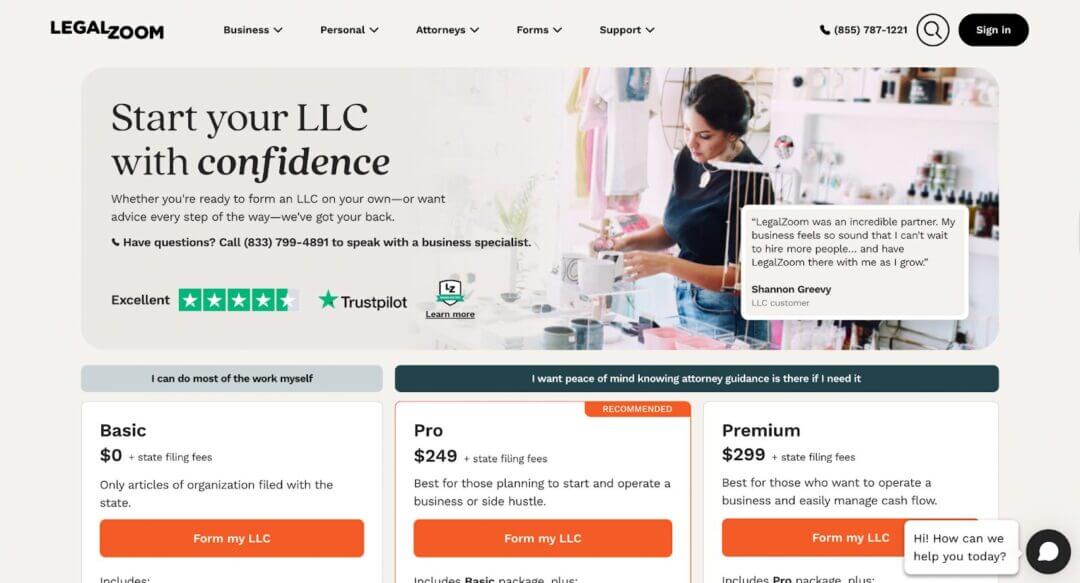

LegalZoom | Best for Brand Recognition, Not Cost Efficiency

It is one of the most widely recognized names in online legal services, including LLC formation and other services.

With a strong legacy, a broad range of legal offerings, and a deep marketing reach, it’s often the first name founders encounter.

However, that recognition comes with trade-offs, especially in pricing and long-term value.

Strengths

- Brand Recognition & Trust: LegalZoom has been serving small businesses for decades, and its name carries weight with some partners and service providers.

- Wide Range of Legal Services: Beyond LLC formation, LegalZoom offers legal document reviews, attorney consultations, trademark services, and more, providing a one-stop solution for founders seeking comprehensive legal support.

- User Experience: The onboarding process is familiar, guided, and relatively easy to follow for beginners.

- Add-on Legal Support: You can purchase access to attorneys for ongoing legal advice (for an additional cost).

Weaknesses

- Higher Cost: LegalZoom’s initial prices are high compared to competitors, and many essential services (registered agent, EIN, compliance alerts) come as paid add-ons.

- Upsells Are Frequent: Founders often encounter multiple upsell prompts, which can significantly inflate the final cost.

- Compliance Tools Are Limited: Basic reminders are available, but dedicated compliance workflows and ongoing support are not as robust as those offered by specialized providers.

- Support Is Not Always Specialized: Customer service is broad rather than focused specifically on formation or compliance nuances.

Best For

- Founders who value brand recognition and want access to broader legal services beyond just LLC formation.

- Businesses that anticipate a need for additional legal documents, trademark help, or attorney access.

- Entrepreneurs who prefer a single provider for multiple legal needs.

Not Ideal For

- Founders looking for cost-efficient LLC formation with minimal upsells.

- International founders needing tailored support for EIN, banking, and U.S. compliance.

- Compliance-focused entrepreneurs who want automated reminders and guidance beyond basic notifications.

Bizee (formerly Incfile) | Best Low-Cost Entry Option

Previously known as Incfile, it is often marketed as one of the most affordable ways to form an LLC.

This makes it an attractive option for first-time founders who want to get started quickly without incurring high upfront costs.

However, the low entry price comes with trade-offs in ongoing support and the depth of compliance.

Strengths

- Very low starting cost: Bizee is one of the most affordable options on the market, often advertising $0 formation plus state fees.

- Free registered agent for the first year: This helps keep initial costs down for new businesses.

- Simple, fast filing process: The platform is straightforward and beginner-friendly for basic LLC formation.

- Decent turnaround times: Formation is generally completed quickly, especially for standard state filings.

Weaknesses

- Limited compliance support after formation: Beyond basic reminders, long-term compliance guidance is minimal.

- Upsells after year one: Registered agent services and other essentials renew at a higher cost after the first year.

- Less suitable for complex needs: EIN help, banking support, and international founder guidance are not as robust as more full-service providers.

- Support quality can vary: Customer support is functional but often less personalized.

Best For

- Budget-conscious founders who want the lowest possible upfront cost.

- First-time entrepreneurs forming a simple U.S. LLC with no immediate plans to scale or expand internationally.

- Founders who are comfortable managing compliance and next steps on their own.

Not Ideal For

- Non-U.S. founders who need help with EINs, U.S. banking, or payment processors.

- Businesses that want ongoing compliance support rather than just formation.

- Founders who prefer an all-in-one solution like doola over a low-cost, DIY-style service.

🔖 Related Read: doola vs ZenBusiness: Which LLC Formation Service Is Best for Your Business?

Northwest Registered Agent | Best for Privacy & Registered Agent Quality

They stand out from the crowd by focusing on privacy, personalized support, and reilable registered agent services that also include LLC formation.

It’s not the cheapest option, but for founders who value privacy and one-on-one guidance, Northwest offers a standout experience that few competitors can match.

Strengths

- Top-Tier Registered Agent Service: Northwest includes registered agent service with all plans, and their team is recognized for its responsiveness and commitment to privacy protection.

- Privacy-Focused Approach: They prioritize keeping your personal information out of public databases and clearly explain any privacy nuances.

- Real People, Real Support: Unlike many competitors with scripted call centers, Northwest offers personable support with deeper expertise.

- Straightforward Pricing: No aggressive upsells; what you see is largely what you get.

Weaknesses

- Higher Price Tag: Northwest isn’t the most affordable option, especially compared to budget entrants like Bizee (Incfile).

- Limited Additional Features: While excelling in privacy and registered agent support, Northwest doesn’t offer the same breadth of services (e.g., banking support, EIN filing, tax compliance tools) as some full-service providers.

- No Free Registered Agent Year: Unlike some competitors that provide a free year of registered agent service, Northwest’s pricing includes it upfront but at consistent annual rates.

Best For

- Founders who prioritize privacy and data protection

- Entrepreneurs who want high-quality registered agent support with real people behind the service

- Small business owners who value personalized guidance over low price points

Not Ideal For

- Founders on a tight budget who just want the cheapest formation

- Businesses that want end-to-end services (like EIN filing, banking, sales tax support) bundled in

- Non-U.S. founders needing global compliance or payment gateway guidance

ZenBusiness | Best for Subscription-Based Support

It is a popular choice for founders who want formation, along with a suite of recurring support tools, under a subscription model.

While it isn’t always the cheapest at first glance, its value lies in bundling ongoing features like compliance reminders, worry-free alerts, and business tools that scale with your company.

Strengths

- Subscription-Focused Support: ZenBusiness packages many post-formation features into easy-to-manage plans, including annual report alerts and compliance monitoring.

- User-Friendly Dashboard: Easy onboarding and intuitive tools make it accessible for beginners.

- Affordable Growth Plans: Tiered offerings allow you to scale support as your business grows without switching platforms.

- Compliance Reminders Built In: You’ll receive regular alerts about state deadlines and filings, helpful for founders who want automation and simplicity.

Weaknesses

- Core Services Can Be Add-Ons: Some essentials, like registered agent service or EIN filing, may not be included in the base price, depending on the plan you choose.

- Feature Gaps for Complex Needs: While strong on automation, ZenBusiness lacks deeper assistance with banking, EIN help for international founders, and tax guidance that some founders need.

- Support Can Vary: Response times and depth of answers depend on your subscription tier and the support channel you use.

Best For

- Founders who want ongoing guidance and automation bundled with formation

- Small business owners who prefer subscription-based compliance tracking over DIY follow-ups

- Entrepreneurs building locally and wanting reminders for reports, fees, and deadlines.

Not Ideal For

- Founders focused primarily on the lowest upfront cost

- Non-U.S. founders needing tailored help with EINs, banking, or global compliance

- Businesses that want deep, personalized support beyond automated alerts

Which LLC Formation Company Is Best for You? And Why?

Not every LLC formation service works for every founder. The right choice depends on your goals, budget, and long-term business objectives.

Let’s break down which provider excels in key founder scenarios so you can match your needs to the best fit.

Best for Beginners

🏆 Winner: doola

While ZenBusiness offers a smooth onboarding experience, doola takes the beginner-friendly approach a step further.

By combining easy formation with ongoing guidance that helps founders understand what’s happening at each stage, doola takes the lead.

From formation paperwork to compliance reminders and real support when you have questions, doola walks you through every step.

Why:

- Simplified onboarding tailored for first-time founders

- Clear explanations at every stage (no legalese)

- Compliance and banking support included

- Personalized support beyond basic formation

Best for International Founders

🏆 Winner: doola

doola provides the deepest support ecosystem for non-U.S. founders, including LLC formation, U.S. EIN acquisition, banking integration, and tax compliance guidance.

Many competitors expect you to handle IRS interactions or banking logistics without U.S. residency, something that can be nearly impossible.

Why:

- Handles EIN filings for non-U.S. founders

- Helps with U.S. bank account setup

- Includes payment gateway readiness (Stripe, Shopify Payments)

- Compliance and tax support in one place

🔖 Related Read: International Businesses and EIN: Navigating US Requirements

Best Budget Option

🏆 Winner: Bizee (formerly Incfile)

If your top priority is minimal initial cost, Bizee offers one of the most affordable entry points, often including a free first year of registered agent service.

It’s ideal for founders who want just the basics without incurring additional costs.

Why:

- Very low or free entry price

- Free registered agent service for year one

- Simple, straightforward filing process

Best for Privacy

🏆 Winner: Northwest Registered Agent

Privacy-minded founders will appreciate Northwest’s top-tier registered agent service and focus on data protection.

The support team emphasizes best practices for privacy and serves as your primary point of contact.

Why:

- Dedicated privacy protections

- Registered agent expertise included

- Personal, knowledgeable support

Best for Long-Term Compliance

🏆 Winner: doola

Compliance isn’t just about forming an LLC; it’s about keeping your business in good standing as it grows.

doola’s compliance support extends far beyond annual report reminders. It includes filings, registered agent services, tax guidance, banking setup, and ongoing access to help you avoid late fees, penalties, and administrative headaches.

Why:

- Built-in annual compliance management

- Tax and reporting guidance

- Ideal for scalable, growth-oriented founders

If you’re still unsure, here’s a simple rule of thumb:

| Founder Type | Best Formation Company |

| Beginner | doola |

| Non-U.S. Founder | doola |

| Budget-Focused | Bizee (Incfile) |

| Privacy-Focused | Northwest Registered Agent |

| Long-Term Compliance | doola |

doola clearly stands out when you want not just a filing service, but a partner in building and managing your business correctly from Day 1.

Key Factors to Consider Before Choosing an LLC Formation Company

Choosing the best LLC formation company isn’t just about the cheapest or fastest.

It’s about matching your needs, today and tomorrow, to the support and services that keep your business healthy, compliant, and ready to scale.

Here are the core factors that separate a service that just forms your LLC from one that supports you as your business grows.

🔖 Related Read: How to Choose the Best LLC Formation Company for Your Budget and Needs

Formation vs. Compliance: One-Time Filing vs. Ongoing Support

Formation is a one-time task, which includes filing your Articles of Organization or Certificate of Formation with the state. Compliance continues forever.

After your LLC is formed, you must:

- Maintain a registered agent

- Keep up with state deadlines

- Understand federal and state tax requirements

Some providers focus only on formation. doola provides ongoing compliance support that keeps you in good standing over the long term.

If your business is in growth mode, ongoing compliance support becomes far more valuable than the initial formation price.

Hidden Costs Over 12–24 Months

A low upfront cost can be misleading. Many providers advertise rock-bottom formation prices, but then:

- Charge extra for registered agent services after the first year

- Charge for compliance reminders or tax support

- Introduce premium features as upsells

When evaluating options, consider the total cost of ownership over a full year or two. A slightly higher upfront price that includes compliance and banking can be more cost-effective than repeated add-ons.

Registered Agent Importance

Every LLC in the U.S. must have a registered agent, a reliable point of contact for legal notices and compliance communication.

A registered agent:

- Receives official mail on your behalf

- Helps ensure you don’t miss critical deadlines

- Keeps your personal address out of public records (privacy protection)

Some services include registered agent support for free only for the first year. Others include it in their long-term plans or integrate it seamlessly with compliance workflows. This matters more than most founders expect.

International Founder Limitations

Non-U.S. founders face challenges that many formation services don’t adequately address, such as:

- EIN applications without an SSN or ITIN

- Opening a U.S. business bank account remotely

- Payment processor approvals (Stripe, Shopify Payments)

- Understanding U.S. tax obligations

Some services are designed with domestic founders in mind and do not offer the tools, guidance, or concierge support international founders require.

Choosing a provider that understands the needs of global founders can save weeks of delays and compliance headaches.

🔖 Related Read: US Tax Filing Requirements for International Founders – Your Guide

Tax and Reporting Responsibilities

Forming an LLC doesn’t exempt you from tax obligations. Your service should help you:

- Understand federal tax classifications (sole proprietorship, partnership, S-Corp, C-Corp)

- Know when you need to file and what forms to use

- Track sales tax nexus and reporting requirements

- Avoid penalties from missed deadlines

Some companies stop helping after the initial setup. Others provide ongoing tax education, reminders, and filing support.

This difference becomes especially meaningful as your business earns revenue and grows in complexity.

Final Verdict: Which Is the Best Company to Start an LLC With?

The right choice depends on who you are as a founder, where you’re located, how complex your business is, and how much support you’ll need after formation.

Filing paperwork is easy. Staying compliant, opening bank accounts, handling taxes, and scaling without issues is where the real difference shows up.

Best for a Solo U.S. Founder on a Budget

If you’re a U.S.-based founder launching a simple business and your top priority is keeping upfront costs as low as possible, a budget-first option like Bizee (formerly Incfile) can work.

Just keep in mind:

- You’ll likely pay more after year one

- Compliance, banking, and tax support are limited

- You’ll be handling many next steps on your own

This route works best if you’re comfortable DIY-ing compliance and don’t expect complexity.

Best for a Privacy-Focused Founder

If protecting your personal information and handling everything independently is most important to you, Northwest Registered Agent stands out.

It’s a strong choice if:

- Privacy is your top concern

- You want real human support

- You don’t need banking, EIN, or tax help bundled in

You’ll get excellent registered agent service, but fewer all-in-one features.

Best for an International Founder

For non-U.S. founders, the decision is much clearer. doola is the best option if you:

- Don’t have an SSN or ITIN

- Plan to use Stripe, Shopify Payments, or Amazon

- Need ongoing compliance and tax guidance

Most LLC formation services are built for U.S. residents. doola is built for both U.S. and non U.S. founders.

Best for E-Commerce Sellers

If you’re running, or planning to run, an online business, especially one selling across states or borders, doola again stands out.

Why?

- EIN + banking support for payment processors

- Compliance support as you scale

- Help navigate sales tax and federal reporting

- Designed for growth, not just formation

E-commerce businesses break when compliance is ignored. doola helps prevent that.

The Verdict

If you only need an LLC filed and want the most affordable option, there are services that can provide that.

But if you want one partner instead of five tools, support beyond day one, and confidence that your business is compliant, doola is the ideal choice.

doola understands that it’s not just about starting an LLC. It’s about building a business that won’t break when you start making money.

Start Your LLC the Right Way With doola

Starting an LLC should feel like a step forward, not the beginning of endless paperwork, IRS confusion, and compliance stress. That’s exactly what doola is built for.

Instead of juggling multiple services for formation, EINs, banking, and compliance, doola brings everything together in one place to eliminate guesswork, missed deadlines, and costly mistakes.

With doola, you don’t just file an LLC. You get a complete foundation for running a compliant U.S. business:

🚀 LLC formation in the right state, done right the first time

🚀 EIN filing, including support for non-U.S. founders

🚀 U.S. business banking setup so you can accept payments and manage finances

🚀 Tax compliance support, including annual filings and ongoing guidance

doola is ideal for founders who want to focus on scaling revenue, and not babysitting paperwork or worrying about compliance traps they didn’t know existed.

Start your LLC with doola today and spend your time building your business, not managing bureaucracy.

FAQs

What is the cheapest company to start an LLC with?

The cheapest company to start an LLC with is typically Bizee (formerly Incfile), especially if you’re aiming to minimize upfront costs.

That said, the “cheapest” isn’t always the best value in the long term, as ongoing compliance tools and EIN support may incur additional costs.

Is it better to start an LLC yourself or use a formation service?

You can start an LLC yourself directly through your state’s Secretary of State website, and it’s often the cheapest option.

For founders who want clarity, support, and fewer legal/administrative headaches, especially non-U.S. residents, a formation service is usually worth the investment.

Which LLC formation company is best for non-U.S. residents?

Many providers aren’t set up to handle international requirements, which can cause delays and errors if you try to navigate on your own.

doola stands out as the best choice for non-U.S. founders. It offers:

- LLC formation tailored for international applicants

- EIN filing without an SSN/ITIN

- U.S. business banking support

- Compliance and tax guidance

Are registered agent services mandatory for an LLC?

Yes, every U.S. LLC is required to have a registered agent. This is the official contact for legal and state correspondence.

A registered agent must have a physical address in the state where your LLC is formed and be available during business hours.

How much does it really cost to maintain an LLC annually?

The annual cost of maintaining an LLC varies by state but typically includes:

- Registered agent fee: $100–$300+ per year (unless included)

- Annual report fee: Usually $50–$200+, depending on the state

- State franchise taxes (if applicable): Some states, like Delaware, have additional fees

- Optional compliance tools: Tax support, bookkeeping, compliance alerts

Total annual costs can range from $200 to over $600+, depending on your service provider and state requirements.

Can I switch LLC formation services after forming my company?

Yes. You can switch formation or compliance service providers at any time.

For example, founders often start with a budget service to file their LLC, then switch to a provider with stronger compliance and banking support later.

What mistakes should I avoid when choosing an LLC formation company?

Choosing the right LLC formation company means considering factors beyond the initial payment.

Consider your operational needs, long-term compliance, and growth path, and pick a partner who supports you every step of the way.

News

Berita Teknologi

Berita Olahraga

Sports news

sports

Motivation

football prediction

technology

Berita Technologi

Berita Terkini

Tempat Wisata

News Flash

Football

Gaming

Game News

Gamers

Jasa Artikel

Jasa Backlink

Agen234

Agen234

Agen234

Resep

Download Film

A gaming center is a dedicated space where people come together to play video games, whether on PCs, consoles, or arcade machines. These centers can offer a range of services, from casual gaming sessions to competitive tournaments.